b&o tax due dates

Gross income includes business activities conducted both. And the due date for the annual returns changed from Jan.

Betterment Resource Center Financial Advice Amp Amp Investing Insights Financial Advice Investing Strategy Managing Your Money

041522 9 penalty begins.

. 31 2021 can provide answers to many questions. Both Washington and Tacomas BO tax are calculated on the gross income from activities. Quarterly returns are due by the end of the month following the close of the quarter.

It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. No BO taxes are due but business must still file a return by April 15 of the following year. The Annual 2019 tax return is due April 15 2020.

In the 2019 session two bills passed that impact city BO tax administration. Taxpayers filing on paper that take deductions can print Schedule D from the link below. January 10 2022.

WHAT ARE THE TAX RATES. See reporting dates below. Annual 2021 due date.

All other businesses pay on an annual basis and will receive their BO tax forms at the end of January. Due dates Monthly returns are due the 25th of every month. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter.

The Quarter 1 Jan Feb Mar tax return is due April 30 Annual returns are due April 15. Its important to know when your taxes need to be filed. Annual 2020 tax return is due April 30th 2021.

BO changes effective 112020 - starting 2020-Q1 43020 due date. The June tax return is due July 25 Quarterly returns are due the end of the month following the tax quarter. BO tax is a gross receipts tax measured on gross proceeds of sales or gross income for the reporting period.

Changes since then in the city code or state law may invalidate some of this information and you may want to check recent ordinances soon to become part of the City Code. West Virginia Code 16A-9-1d. Filing due dates Print.

The unsecured bills are subject to lien and an. Annual 2022 due date. Its important to know when your taxes need to be filed.

The second month increases to 19 of the tax and the third month increases to. Restaurants In Matthews Nc That Deliver. Due Dates 2013 - 2018 due dates Monthly returns are due the last day of the month following the tax month eg.

Generally businesses grossing in excess of 400000 are assigned a quarterly schedule and the BO Tax is due and payable on the last day of the month following the reporting period. In an effort to reduce paper waste Schedule D will no longer be included with quarterly and annual tax form mailings. Essex Ct Pizza Restaurants.

Credit definitions provide detailed instructions for reporting credits on the tax return. Annual due dates are listed below for the Combined Excise Tax Return. The due date for annual filers will remain April 30 going forward.

The filing deadline is April 15. The City of Des Moines recently notified all local businesses that file quarterly tax returns that because of the COVID-19 coronavirus outbreak it has extended the due date for City Business and Occupation Tax by three months. Annual total gross revenues over 750000 Must file and pay taxes quarterly on.

Credits are subtracted from the BO tax due on your excise tax return. Here you can check your filing due dates to make sure your tax return gets in on time. The City will also be waiving any late fees during this time for businesses that take advantage of this extension.

If the due date falls on Saturday Sunday or a legal holiday the return or voucher may be filed on the first business day thereafter. File by Mail or In Person BO Tax Form PDF Complete the above form and make your check or money order made out to the Finance Director. HB 1403 related to service income apportionment and HB 1509 related to annual tax filing deadlines.

Washington unlike many other states does not have an income tax. June tax return is due July 31 Quarterly returns are due the end of the month following the tax quarter eg. The BO Tax Guide with information current as of Dec.

A city workgroup met over the summer of 2019 to review changes needed to the BO model ordinance. Bo tax due dates Thursday May 26 2022 The Quarter 1 Jan Feb Mar tax return is due April 30 Annual returns are due April 15. The City Business Occupation BO tax is a gross receipts tax.

Annual total gross revenues between 20000 and 750000 Must file and pay taxes by April 15 of the following year. 041622 19 penalty begins. Month following the due date the penalty is 5 or 9 of the tax whichever is greater.

060122 29 penalty begins. Delivery Spanish Fork Restaurants. Penalty and interest will be applied against any return that is received after these months.

April 30 July 31 October 30 January 31. Electronic funds transfer EFT 2022. Tax Year BO Filing Due Date Reporting Period 2016-2019 January 31 January 1 - December 31 2020-Current April 30 January 1 - December 31 Quarterly Filers Generally any business with revenue over 1 million per year will be required to report and pay BO taxes quarterly.

If you fail to pay your Unsecured Property Taxes by the delinquency date a 10 penalty will be added. It is the owners responsibility to ensure filings are returned prior to their due date. Depending on your situation filing your Seattle taxes may be relatively simple or fairly complex.

Tax Guide Tax Forms Tax Rate Voluntary Disclosure Due Dates Other Taxes Everett Business Tax Guide PDF. ABO Tax returns are due within one month following the end of the taxable quarter. The Seattle business license tax is applied to the gross revenue that businesses earn.

Annual due dates are listed below for the Combined Excise Tax Return. If the unsecured bill remains unpaid on the last day of the second month after the 10 penalty was added an additional penalty of 15 will accrue on the first day of each month until paid. Pin On Fotografia Produktowa For example for a taxable gross revenue amount of.

31 to April 15th. It is measured on the value of products gross proceeds of sales or gross income of the business. Bo Tax Due Dates.

Quarter 1 tax return is due April 30 Annual returns are due by April 30 eg. Quarterly payments are due in April July October and January. Income Tax Rate Indonesia.

If you have difficulty opening this form make sure you have the latest version of Adobe. Opry Mills Breakfast Restaurants. The tax rate depends on the classification of your business activity.

Soldier For Life Fort Campbell. 070122 Looking for the due date for the 2020 Annual return.

The 10 Closest Hotels To Bad Aibling Station

Jabra Evolve2 75 Link380a Ms Stereo Beige 27599 999 998

The 10 Closest Hotels To Bad Aibling Station

1mii Bluetooth Transmitter Tv Long Range Bluetooth Audio Transmitter With Dual Antenna Aptx Low Latency Hd Aux Rca Optical Coaxial Audio Inputs Amazon De Electronics Photo

Meet Pearson Airport S New Therapy Dogs Therapy Dogs Dogs Therapy Animals

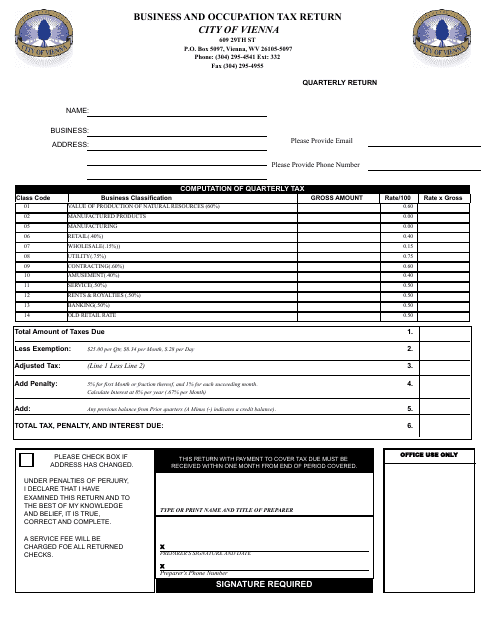

City Of Vienna West Virginia Business And Occupation Tax Return Download Fillable Pdf Templateroller

Cheap Hotel A O Berlin Hauptbahnhof Berlin From 9 Night

Business And Occupation B O Tax Washington State And City Of Bellingham

Airy True Wireless Earbud Single Right Teufel

B Amp O Tax Return City Of Bellevue

Mercedes Benz Gle 63 Amg Gle 63 S Amg Coupe New Buy In Hechingen Bei Stuttgart Price 176120 Eur Int Nr 20 430 Sold

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting

Garmin Quarter Turn Mount For Quickfit Bicycles 3 Units With 20 22 And 26 Mm Holder Unisex Adult Black One Size Size Amazon De Sports Outdoors

%20Taxes/bo-tax-header.jpg)